How Can I File Charges Agains Netspend

Netspend – An Overview

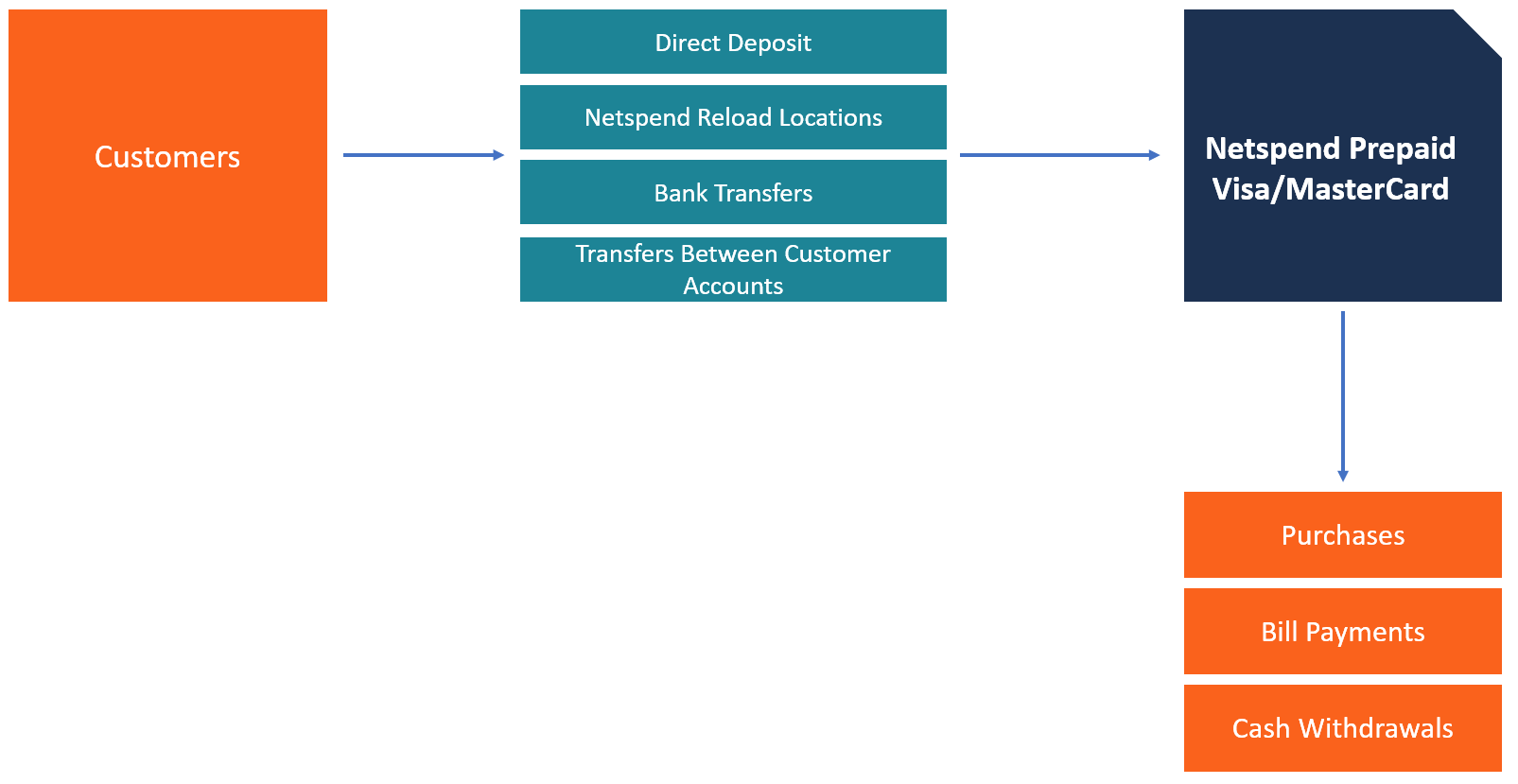

Netspend is an Austin-based visitor that offers prepaid debit cards, usually Visa or Mastercard, that tin can exist used to make in-store purchases, store online, and withdraw greenbacks at ATMs. The Federal Deposit Insurance Corporation acts as a guarantor and provides insurance for all of the transactions that are made with the carte du jour.

Customers can order a Netspend card online from the company'due south website or purchase i at participating retailers at a pocket-sized fee. The cards are sent via mail service within seven to x days subsequently making an guild online. On receipt, customers must actuate the cards and deposit funds into the card before they can brainstorm using it to make purchases and pay bills.

How to Open up an Business relationship Online and Go a Netspend Card

Opening an account on the Netspend website is relatively simple. Customers are required to provide their name, concrete address, and e-mail address. On the Netspend.com website, first compare the various packages by looking at the features, fees, and benefits of each package. In one case you lot've identified the parcel that fits your preferences, click the sign-up button to open up the sign-upwardly page. The page requires users to input their name, address, and email address .

The side by side stride is to select the preferred color from a choice of four different colors. Then, create a username, countersign, and a security question. In one case the application is approved, log into the customer portal and gild your Netspend carte du jour. The card will be delivered via registered mail within seven to 10 days.

An alternative to the online application is to purchase the company's card from an authorized retailer such equally a gas station, grocery store, or check-cashing store. Participating stores usually display the company'south sticker at the counter. Vendors require customers to provide their proper name, address, appointment of nascence, and make a re-create of an official identity document such as a passport or driver's license. Retailers usually sell the cards at a fee ranging from $2.95 to $4.95.

How to Use Netspend Cards

NetSpend prepaid cards can be used to pay for shopping, refill your gas tank, pay online bills, and withdraw cash from ATMs. They have the flexibility of being used as a credit card and as a debit bill of fare. They typically include a $one transaction fee whenever used as a credit card, and an even higher fee of $ii when used every bit a debit card. There are variations to the corporeality of these fees but they are unremarkably in the $1-$2 range. There are also fees for cash withdrawals at ATMs, which will typically vary on location, with international withdrawals having more than expensive fees.

If you are a large user, you can upgrade your subscription to the FeeAdvantage Plan or Netspend Premier FeeAdvantage Programme that charges $five.00 and $9.95 per month, respectively. Over-the-counter cash withdrawals are charged $2.50 per transaction, plus a transaction surcharge for strange OTC cash withdrawals. Domestic ATM greenbacks withdrawals are charged $2.50 per withdrawals while international cash withdrawals are charged $4.95 per withdrawal, plus the foreign transaction surcharge.

How to Add Funds to the Netspend Menu

There are several ways that customers can use to add funds to their accounts. They include:

Direct deposit

Direct deposit is the well-nigh convenient manner to reload funds into the Netspend prepaid card without incurring whatever expenses. Customers can choose to eolith their paychecks and regime benefits directly to their prepaid cards. Tax refunds from the IRS can also be deposited directly to the card account.

Netspend Reload Locations

Netspend lists over 130,000 locations around the U.s.a. where cardholders can add together coin to their accounts. The company'southward website offers a reload center locator that customers can use to find the most convenient reload locations near their cities.

Banking concern Transfers

Customers can also add coin to their Netspend accounts from any U.S.-issued bank account. They can utilise their bank debit cards, savings, or checking account balances to add funds to the carte du jour.

PayPal

PayPal as well offers a convenient fashion where customers can link their Netspend cards and eolith money directly to the prepaid cards.

Transfer Between Netspend Carte du jour Accounts

The company also allows customers to transfer funds from 1 Netspend carte du jour business relationship to some other account at a small fee.

Netspend Overdraft Protection

Netspend overdraft protection allows prepaid cardholders to incur fees or complete transactions that exceed their card account balances. Customers are allowed to utilise the overdraft protection service upwards to three times per calendar month. Customers are charged a transaction fee of $15 overdraft transaction services for client withdrawals that exceed their menu balance by more than $ten.

However, for customers to enjoy this protection, they must meet certain activation and eligibility requirements. One of these requirements is that customers must provide a valid email address and hold to the company's electronic delivery of disclosures and amended terms to the overdraft protection contract. Also, account holders must make deposits to their bill of fare in excess of $200 every 30 days to go on using the service.

More than Resource

Give thanks you for reading CFI's guide to Netspend. CFI is the official provider of the global Financial Modeling & Valuation Annotator (FMVA)™ certification programme, designed to help anyone become a earth-class fiscal analyst. To keep advancing your career, the additional resource below will be useful:

- Bargain Buy

- All-time Buy Credit Card

- Cryptocurrency

- Retail Bank Types

Source: https://corporatefinanceinstitute.com/resources/careers/companies/netspend/

0 Response to "How Can I File Charges Agains Netspend"

Publicar un comentario